How to Recover Financially After Catastrophic Injury

Experiencing a catastrophic injury can turn your world upside down. These injuries (often resulting from serious accidents, workplace incidents, or other traumatic events) can lead to long-term or permanent physical, emotional, and financial challenges.

While physical and emotional healing are crucial, learning how to recover financially after injury is equally important for rebuilding stability and planning for the future. This often involves careful planning, understanding your resources, and seeking professional support.

This guide offers practical steps, resources, and strategies to help you regain control and navigate the financial challenges ahead.

Immediate Financial Steps After a Catastrophic Injury

The days and weeks following a catastrophic injury can be overwhelming. It’s essential to address immediate financial concerns to prevent further stress:

- Assess Your Financial Situation:

List your current expenses, including medical bills, daily living costs, and any outstanding debts. Knowing where you stand helps prioritize urgent payments.

- Access Emergency Financial Resources:

Contact your health insurance provider to understand coverage, file claims quickly, and inquire about emergency assistance programs. Government programs and charitable organizations may provide temporary support for disabled individuals or those with catastrophic injuries.

- Notify Key Parties Early:

Inform your employer, creditors, and insurance companies about your injury. Early communication can prevent late fees, paused accounts, and lost benefits.

- Document Everything: Keep detailed records of medical treatment, bills, and communications with insurers. Documentation is critical for future claims or legal action.

Understanding Insurance and Legal Options

Insurance can be complicated, and navigating multiple policies can feel like a full-time job. Health insurance, disability coverage, workers’ compensation, life insurance, and car insurance all have different rules, limits, and deadlines. Fully understanding these policies is key to ensuring you get the benefits you’re entitled to.

Legal help can make a significant difference in catastrophic injury financial recovery. A skilled attorney can help you pursue compensation if your injury was caused by someone else’s negligence, negotiate claims with insurance companies, and guide you through workers’ compensation processes.

Legal expertise is especially valuable for ensuring you access the full spectrum of disability benefits, and it protects you from common pitfalls that can reduce or delay payments.

Building a Long-Term Financial Plan

Recovering financially after a catastrophic injury means covering today’s bills while also building a roadmap for tomorrow. Without careful planning, ongoing medical expenses, reduced income, and long-term care costs can quickly overwhelm even the most disciplined budget.

Step 1: Create a Comprehensive Budget

Think of your budget as a map of your financial recovery journey. Include:

- Rehabilitation and therapy costs

- Adaptive equipment or mobility devices

- Home modifications for accessibility

- Daily living expenses (groceries, utilities, transportation)

- Emergency medical fund

Step 2: Manage Debt Strategically

Debt can compound stress after an injury. Strategies include:

- Negotiating payment plans or deferments with creditors

- Exploring debt consolidation for manageable payments

- Prioritizing high-interest loans to reduce long-term financial burden

Step 3: Plan for Long-Term Care

Some injuries require ongoing support. Consider:

- In-home care or professional caregivers

- Long-term physical therapy

- Specialized equipment and mobility aids

Accessing Financial Assistance Programs

Recovering financially after a catastrophic injury means covering today’s bills while also building a roadmap for tomorrow. Without careful planning, ongoing medical expenses, reduced income, and long-term care costs can quickly overwhelm even the most disciplined budget.

Step 1: Create a Comprehensive Budget

Think of your budget as a map of your financial recovery journey. Include:

- Rehabilitation and therapy costs

- Adaptive equipment or mobility devices

- Home modifications for accessibility

- Daily living expenses (groceries, utilities, transportation)

- Emergency medical fund

Step 2: Manage Debt Strategically

Debt can compound stress after an injury. Strategies include:

- Negotiating payment plans or deferments with creditors

- Exploring debt consolidation for manageable payments

- Prioritizing high-interest loans to reduce long-term financial burden

Step 3: Plan for Long-Term Care

Some injuries require ongoing support. Consider:

- In-home care or professional caregivers

- Long-term physical therapy

- Specialized equipment and mobility aids

Accessing Financial Assistance Programs

With medical bills, lost income, and ongoing care costs, relying on a single resource is rarely enough. To create a strong financial safety net, most individuals need to tap into a combination of insurance, legal assistance, and community or government programs.

Below is a snapshot of key government programs designed to provide financial support during your recovery:

| Program | What It Provides | Who Qualifies | Notes |

|---|---|---|---|

| Social Security Disability (SSD) | Monthly income | Individuals with a qualifying disability | It can take months to process. Apply early |

| Supplemental Security Income (SSI) | Monthly income | Low-income disabled individuals | Often paired with SSD |

| State & Local Programs | Medical cost coverage, housing assistance, and adaptive equipment | Varies by state | Check local government websites for eligibility |

Nonprofits & Charities: Organizations may offer grants, emergency funding, or guidance for navigating government programs. Hospitals and rehabilitation centers often maintain resource lists—don’t hesitate to ask your social worker or case manager for referrals.

Tip: Keeping a “resource tracker” spreadsheet of program contacts, application deadlines, and documentation requirements can simplify the process and reduce stress.

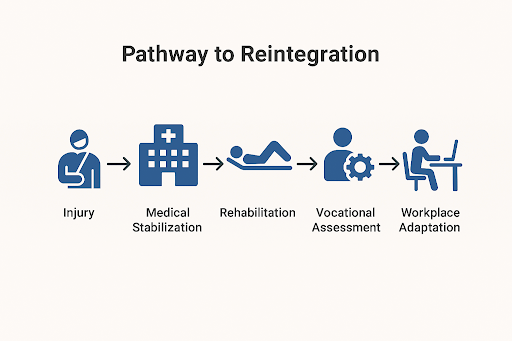

Returning to Work and Exploring Vocational Options

Returning to work after a catastrophic injury is rarely a straight path. Recovery timelines, physical limitations, and emotional challenges all influence how and when you can re-enter the workforce.

The key is flexibility: combining realistic goals with adaptive strategies allows you to regain financial independence without compromising your health.

Workplace Adjustments

Many employers are legally required to provide accommodations under the Americans with Disabilities Act (ADA), and understanding your options can make a huge difference:

- Part-time or Remote Work: Gradually returning to work with reduced hours or telecommuting can help you balance rehabilitation with job responsibilities.

- Adaptive Equipment & Assistive Technologies: Ergonomic desks, speech-to-text software, or mobility devices can create a safer, more manageable work environment.

- Modified Responsibilities: Tasks can be shifted or adjusted to match your current capabilities, ensuring productivity while preventing injury relapse.

Vocational Rehabilitation Programs

Vocational rehabilitation (VR) programs are designed to bridge the gap between recovery and sustainable employment.

They provide:

- Skills Development: Retraining or certification programs to adapt to new career paths.

- Career Exploration: Guidance on job roles that match your abilities and long-term goals.

- Workplace Integration: Support in transitioning back into a professional setting with adaptive strategies.

VR programs often work in conjunction with disability insurance or workers’ compensation to ensure a smooth, financially secure return to work.

Addressing the Emotional Cost of Financial Stress

Financial stress can take a heavy toll on emotional and mental well-being. Struggling with medical bills, mounting debt, or sudden income loss often triggers feelings of anxiety, depression, irritability, and overwhelm.

Left unaddressed, these emotional burdens can interfere with daily functioning, strain relationships, and even slow physical recovery from injury or illness.

Strategies to Cope

1. Professional Support

Therapy or counseling can provide effective tools to manage anxiety, stress, and financial worries. Cognitive-behavioral therapy (CBT), for instance, can help reframe negative thoughts about money, reduce catastrophic thinking, and improve coping skills.

Financial therapists combine mental health strategies with money management guidance, helping clients navigate the emotional side of financial stress.

2. Peer Support

Connecting with others facing similar financial challenges can be incredibly validating. Support groups—online or in-person—allow individuals to share experiences, exchange practical tips, and feel less isolated.

Hearing how peers cope can normalize feelings of worry or guilt and inspire strategies that have worked for others.

3. Financial Simplification

Breaking finances into manageable steps can reduce overwhelm and restore a sense of control.

Start by:

- Prioritizing obligations: Identify essential bills and focus on covering these first.

- Automating payments: Reduce the mental load by setting up auto-pay for recurring expenses.

- Visual tracking: Charts, graphs, or checklists can make progress tangible, boosting motivation and reducing anxiety.

4. Mindfulness and Stress Reduction Techniques

Mindfulness practices, meditation, deep breathing, or journaling can calm the nervous system and reduce financial anxiety. Even 5–10 minutes a day of mindful reflection or structured breathing exercises can improve emotional resilience.

5. Practical Financial Planning

Working with a financial counselor or planner can provide structure and clarity. They can help create realistic budgets, negotiate payment plans, or identify community resources for medical bills and debt relief.

Knowing there is a concrete plan in place can alleviate the “paralysis” that financial stress often causes.

6. Self-Care and Boundaries

Protecting emotional energy is essential. Set boundaries around financial discussions that trigger stress, and engage in activities that provide relaxation, joy, or a sense of accomplishment.

Physical exercise, creative hobbies, or simply stepping away from screens can help maintain emotional balance.

How Bradley Grombacher LLP Can Help

Navigating the financial aftermath of a catastrophic injury is complex, but you don’t have to do it alone.

Bradley Grombacher LLP specializes in helping individuals secure compensation, manage insurance claims, and access the financial support needed for long-term recovery.

Our team guides clients through:

- Filing claims with the help of a

personal injury attorney

- Understanding and maximizing disability benefits and insurance claims

- Accessing financial assistance for disabled individuals

- Building a comprehensive strategy for catastrophic injury financial recovery

We work with clients to protect their financial future, allowing them to focus on healing and adjusting to new circumstances.

For detailed information on how we can help, visit our catastrophic injuries page.

Taking Control of Your Financial Recovery

Financial recovery after a catastrophic injury is a process, making early action critical. Starting your financial plan as soon as possible, seeking professional guidance, and exploring all available resources can make the path forward less overwhelming and more sustainable.

If you or a loved one has suffered a catastrophic injury, contact Bradley Grombacher LLP today for professional guidance. Learn how we can help with legal help after catastrophic injury, insurance claims, and financial planning to ensure a secure and manageable recovery.